Disney’s claims of being The Happiest Place on Earth, are being questioned by a media-analyst group because of the way Wall Street values the entertainment giant.

Researchers at MoffettNathanson do not know what to make of the “shocking… underperformance” of Disney shares (DIS) — which have declined in value by 30 percent since early 2021. This, in comparison with the fact that the rest of the stock market has risen by at least 30 percent in the same timeframe, analysts say that the DIS “paints a depressing picture” through its downward trend. Not only that, the trend does not quite make sense either.

Nathanson has admitted that while all media stock across the board is struggling, Disney is not really a media-only company and their parks and resorts business has seen an “amazing resurgence” since Covid-19. With this in view, analysts cannot understand why “the market has overly punished” DIS.

It is to be noted that Disney shares are not the worst-performing media stock — Paramount Global has seen a 49 percent decline and Warner Bros. Discovery has seen a 54 percent downward trend. But when compared to the fact that neither of these companies has parks, experiences, and consumer products business bringing in cash flow, Disney’s one-third decline in value starts to look quite steep.

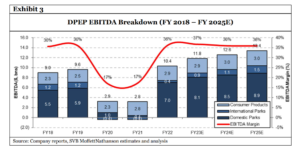

According to MoffettNathanson, Disney’s parks are “the biggest driver of Disney profits,” and the company should be valued as a travel and leisure company. The analysts claim that the parks are an “overlooked crown jewel” which is of “increasing importance” to Disney’s financial health and future.

According to Nathanson’s calculations, the enterprise value of Disney’s U.S. Parks is $105 billion, and the international parks add over $30 billion, while consumer products contribute $35 billion, making the total enterprise value around $170 billion. This implies that the remaining businesses of The Walt Disney Company contribute only $60 billion to its overall enterprise value of $230 billion.

In other words, almost 75% of Disney’s total value is attributed to its parks, experiences, and products, while the remaining 25% is derived from the other three-quarters of the company, which include its entertainment (linear, streaming, and studios) and ESPN divisions.

With a current market capitalization of approximately $182 billion, Nathanson estimates that the television and film businesses of Disney, including streaming, would have an enterprise value of $60 billion, which is $100 billion less than Netflix’s enterprise value of $163 billion and lower even than Warner Bros. Discovery’s enterprise value of $79.3 billion.

“Would investors really put a significant discount on owning Disney+, Hulu, ESPN, ESPN+, India’s Star/Hotstar and even the Disney Studio (Marvel, Star Wars, Pixar, Disney Animation) and the entire Disney film and TV library?” Nathanson has asked in his 18-page research report. “We believe all of these assets should trade at a premium to Warner Bros. Discovery and at a much narrower gap to Netflix.” Nathanson maintains that DIS should be worth $130 a share, not the $99-and-change it presently trades for.

Would you like to know more about Disney’s stock? Please let us know!

Wells Fargo’s equity analysts have judged the situation even more harshly than their colleagues at MoffettNathanson when it comes to evaluating Wall Street.

After analyzing the Disney earnings report on February 8, Wells Fargo increased its DIS price target from $125 to $141. They estimated that Disney’s equity value was $257 billion, out of which $167 billion was attributed to its Parks/Experiences division. However, unlike enterprise value, equity value takes into account the company’s future potential. At the time of their evaluation, Disney’s shares were trading about $12 higher than their current price.

Disney cannot be absolved of responsibility for the present dilemma of its valuation. One of the primary issues is its insufficient free cash flow, which amounted to just $1.3 billion in fiscal 2022, a significant drop from its peak of $10.1 billion in 2018. Furthermore, Disney’s management cannot guarantee that Disney+ will become profitable by 2024. Additionally, the future of Hulu is uncertain, with a significant impending cost that hangs over Disney as it currently owns two-thirds of the streamer and has to buy out Comcast’s one-third in around eight months. Despite CEO Bob Iger’s positive comments on the brand, the future of ESPN is also uncertain.

Nathanson believes that Disney’s free cash flow for the current year will be $4.6 billion, mainly due to the reduction in content spending. However, almost all of this increase in cash flow can be attributed to the parks.